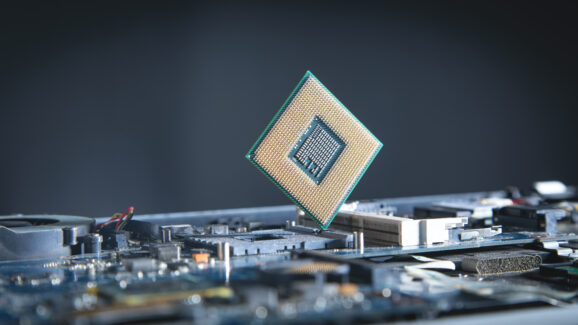

Activity: In the Chips — A Market in Computer Chips

Read Across America Day 2026: Celebrating a Nation of Diverse Readers

March 2, 2026 When we asked our staff what they are reading right now, the responses felt exactly like FTE…

Empowering Educators: Michele Mar’s Journey with FTE

February 26, 2026 FTE’s commitment to excellence in economic education starts with its teachers – and each year, we have…

The True Cost of Glory: What Economics Teaches Us About the Winter Olympics

February 19, 2026 As Norway celebrates its 15th gold medal and Italy rallies behind its home team’s nine golds at…